Categories

This resource is provided by WLJ attorneys Sidney Leasure and Greg Jones.

Click here to download the PDF.

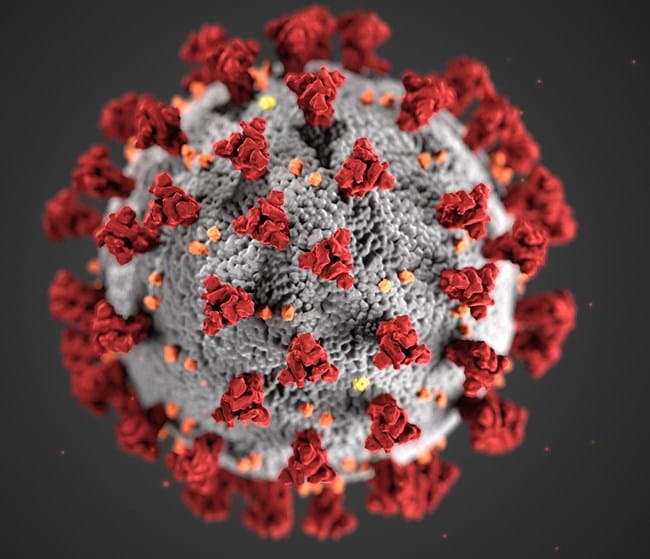

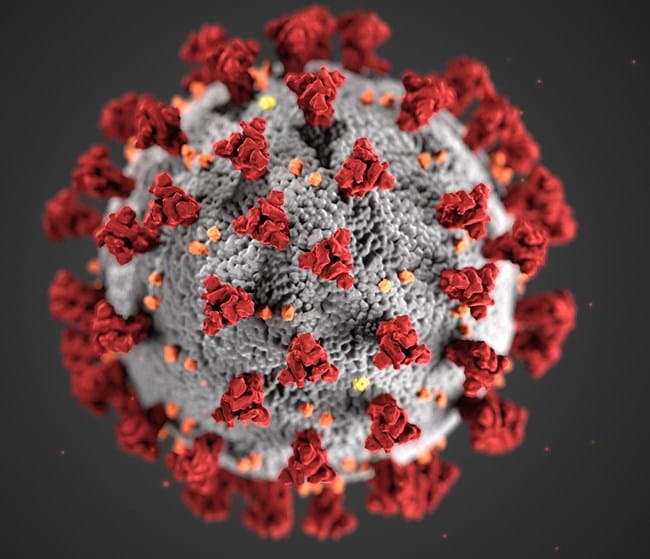

The Uncertainties of COVID-19

The COVID-19 pandemic has created many uncertainties about how long and to what extent business will be interrupted and how business relationships will be impacted. The only thing that is certain is that there will be interruptions.

- Even if your business continues without interruption, companies with whom you do business may experience supply chain interruptions, changes to regulations, or staffing issues that may prevent them from meeting their contractual obligations.

- Lenders may restrict access to capital that is normally relied on—loans may be approved at a slower pace, draws on lines of credit may be processed more slowly, or lenders may seek additional security or guaranty before proceeding with loans.

- Government licenses, approvals or processes may slow as governmental agencies direct attention and resources to the effects of the virus and experience interruptions of their own.

While these are just a few examples of how COVID-19 may impact your business, it is important to review all outstanding contracts in order to ready your business as much as possible against what may happen. Before acting under an existing contract or entering into a new one, you should consider your contractual rights and obligations, and those of the other party.

What is “Force Majeure?” Does it Apply to COVID-19?

A force majeure clause in a contract may allow one or both parties some relief when extraordinary events delay or prevent performance under the contract. Sometimes listed as “Acts of God,” the extraordinary events that constitute a force majeure are not reasonably foreseeable and rarely occur. Events typically listed in force majeure clauses are war, natural disasters, governmental directives preventing performance and, potentially, global pandemics.

Force majeure clauses are found in all types of contracts, including leases, supply contracts, and commercial loan agreements, among others. Many contracts will identify such a provision with the title “Force Majeure,” or the term itself may be used in the contract clause, but your contract may contain a force majeure clause even when those specific words do not appear. Instead of seeing a force majeure clause, your contract may specify extreme or extraordinary circumstances that can alter performance obligations. Examine your contracts for these types of provisions to determine whether they address events like a pandemic or the changes in governmental rules and regulations that have come with it.

Because relief under force majeure depends on the contract’s language, careful attention must be paid to the way the provision is worded. If the language does not mention pandemics specifically, then the clause might not provide the relief you are seeking. Yet, if the provision addresses changes to laws or regulations or has some broader catch-all language, it may still provide relief.

Naturally, the first step in thinking about the effects of COVID-19 on your contractual obligations is to evaluate whether your contract(s) have such an explicit or implicit force majeure clause. If so, you should determine whether it covers an event such as COVID-19. If you are confused about whether a force majeure clause applies, Wright, Lindsey & Jennings can help you in your analysis.

What If a Contract Has No Force Majeure Clause?

Even if your contract lacks a force majeure clause or if it does not specifically address pandemics, other areas of contract law may provide relief.

Impossibility

If your contract lacks a force majeure clause, certain legal principles under Arkansas law and general contracts common law will apply when unforeseeable circumstances interrupt business and make it impossible or impractical to perform (often referred to as the “doctrine of impossibility”). Financial hardship specific to you—for example, a less-profitable deal—will not excuse performance or justify termination of the contract, even if many others are experiencing the same hardships. (If you are experiencing financial hardships that are impeding your ability to conduct business, please see our information on financial resources in response to COVID-19).

For the doctrine of impossibility to apply, an unforeseeable event must have intervened that would prevent anyone from performing under the contract. For example, assume that a party is obligated to deliver leather goods made in Italy, but imports from Italy are halted due to a pandemic and purchasing substitute fixtures from a third party is impossible or wastefully expensive. Unless the contract puts the risk of a pandemic or a government embargo of goods on the party responsible for delivering the leather goods, then the supplier may be excused from the contract due to the doctrine of impossibility.

Be mindful that some contracts explicitly contemplate that a particular event might occur and place the risk of it occurring on one of the parties. In such instances, the terms of the contract will control, and the “Act of God” occurrence will not relieve a party of its obligation to perform. While it is difficult to imagine a contract that addressed the occurrence of a worldwide pandemic like COVID-19, it is not unreasonable to think a contract may address events such as supply chain disruptions. Analyzing the wording and construction of each contract will be very important.

Frustration of Purpose

A variant of the impossibility doctrine that can also be triggered by unforeseeable events is known as “frustration of purpose” or “commercial frustration”: these doctrines are available only when the contract lacks a force majeure clause or provisions putting risk on one party. Frustration differs from impossibility in the possibility to perform—impossibility applies when performance is impossible or nearly impossible; frustration applies when performance remains possible, but the unforeseeable circumstance has made performance so meaningless, the parties would not have entered into the contract had the circumstances been known prior to execution.

As an example, assume that a business rents a convention center to hold its annual conference. If a tornado destroys the convention center, the doctrine of impossibility applies, and the business is excused from performing and can terminate the contract. If instead the convention center is leased but the convention is cancelled due to COVID-19 concerns, it may still be possible to rent the convention center, but the purpose of renting the building has been frustrated. Therefore, the business may be excused under the doctrine of frustration of purpose.

What to Do Next

The doctrines of force majeure, impracticability, or frustration of purpose will apply only in extreme circumstances. Ceasing performance under an existing contract or termination of a contract under these doctrines is challenging, and relying on these without careful consideration could put a party at risk for breach of contract if ill-conceived. If the rights and responsibilities under your contract have become unclear due to the pandemic, there may be other options such as seeking a declaratory judgment. This type of lawsuit allows the parties to resolve issues early, rather than facing uncertainty over an extended period of time.

Before taking action on an existing contract, or responding to another party who is seeking to take action, consider the following:

- Review the contract for provisions that discuss force majeure or acts of God or rare events. The interpretation may be nuanced. If you need assistance in reviewing your contracts, Wright, Lindsey & Jennings would be happy to assist you.

- Re-read contracts you are about to enter into, including the form or “boilerplate” contract language. Consider whether to add or revise a force majeure clause.

- After reviewing your contracts, talk with the other parties to the contract. Learn about any potential interruptions or complications to performance they now have or may have in the future that could affect the value of their contract with you or impact your ability to perform under a contract that you have with someone else.

- Similarly, if you are a supplier or purchaser under a supply contract, consider your supply chain and make contingency plans to address potential disruptions. If you feel you may have difficulties in the future, there may be options you can take now that may protect you or mitigate damages. We are available to offer you a legal perspective on how to address these concerns.

- Evaluate your insurance policies and talk with your insurance broker regarding your business interruption insurance or other forms of applicable coverage. This is a good time to determine if your coverage is sufficient or if you need to seek this insurance.

- Talk with your lender to understand what actions it may take concerning access to credit or loans, actions on existing loans, or its business operations in a way that could affect you. If access to capital concerns you during this time, consider the loans available through the Small Business Administration. Access to these loans has been expanded with the CARES Act, and you may qualify for loan forgiveness. You can find more information on this topic here.

COVID-19 continues to spread, affecting the health of our citizens and businesses. We hope for your safety and health in this uncertain time. We also understand that protecting your business will be critical to you as this situation unfolds. Wright, Lindsey & Jennings is here to assist you in navigating these issues.

This memorandum is provided by Wright, Lindsey & Jennings, LLP for educational and informational purposes only and is not intended and should not be construed as legal advice. Businesses and individuals with additional questions should contact Fred Perkins, Sidney Leasure, Cal Rose, Greg Jones or any other WLJ Business Team attorney.