Categories

This article originally appeared online at Arkansas Business on March 20, 2019.

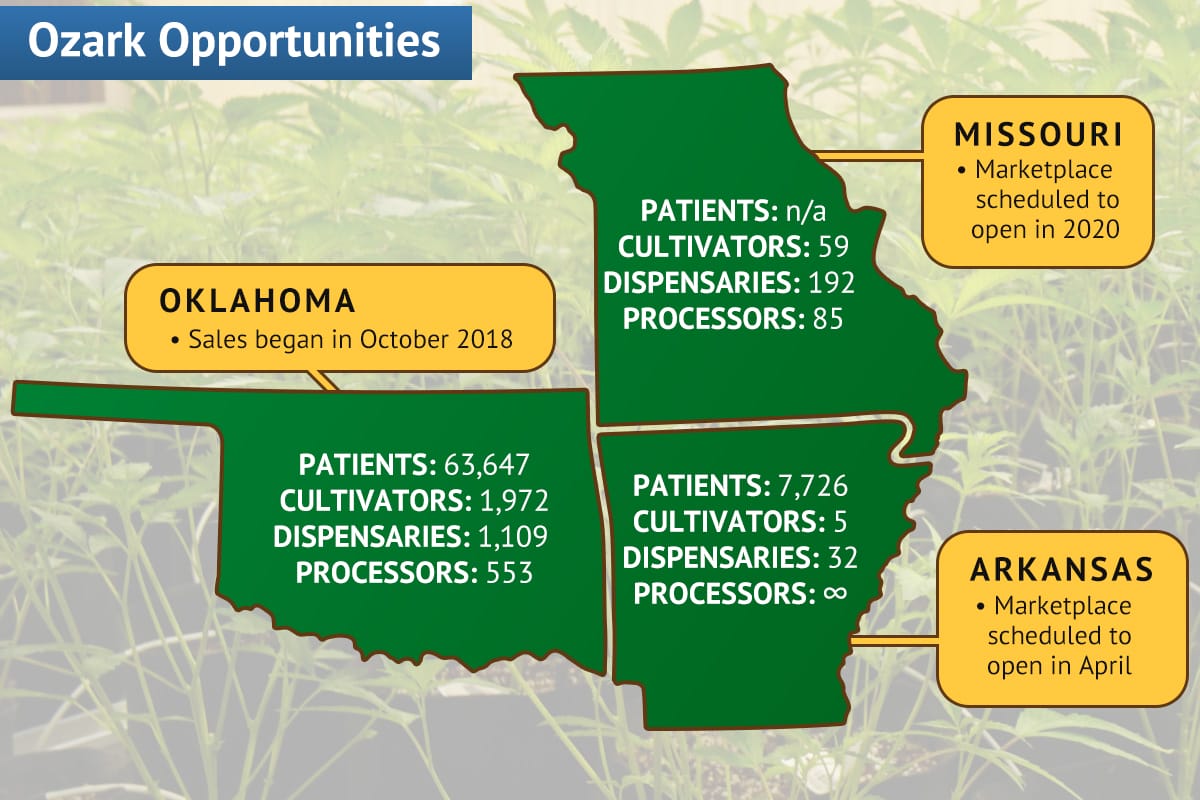

The “green rush” has come to the heartland, with Arkansas, Oklahoma and Missouri all legalizing medical cannabis in the last couple of years.

Although opportunities to enter the cannabis space seem to be everywhere, many would-be investors don’t realize that the strictly intra-state nature of this industry means that each state has its own unique market, with its own challenges and difficulties. This article will take a closer look at each of these states and the opportunities they present to investors.

Arkansas

Although it was the first state in the region to legalize medical cannabis, Arkansas is not yet operating. The best estimate is the first dispensaries will open in April or May, with the remaining dispensaries coming online later this year. The protracted delay has been a source of frustration for patients, but it also means that investors still have time to enter the market as it opens.

Since all the cultivation and dispensary licenses expected to be available in the near term have been awarded, the best opportunity for an investor is to seek one of the new processor licenses expected to be available in the next few months.

Unlike the cultivation and dispensary licenses, the state does not plan to limit the number of processor licenses available, making this one of the few ways to get into a “plant-touching” business in Arkansas. In addition, processing is a very broad category, allowing you to do anything from operate a cannabis bakery on the corner to operate a huge plant manufacturing capsules, pills and patches. Arkansas also offers opportunities in ancillary services/products, such as growing supplies, security and equipment sales.

One of the challenges of the Arkansas market is that a fairly limited set of qualifying conditions coupled with the long delay in opening has suppressed the number of patients seeking licenses — after 2 ½ years, the state still has only 7,726 licensed patients. Unless the patient licenses can be significantly increased, it will be difficult for cannabis businesses to have enough customers to operate.

Oklahoma

It’s difficult to convey what a booming market Oklahoma has become since legalizing medical cannabis in June and quickly beginning sales that October.

In that short time, the state has licensed 1,109 dispensaries, 1,972 growers and 553 processors, and has been so inundated with applications that it had to shut down its phone center to concentrate on processing licenses.

One might think that a state of 3.9 million people could not possibly support that number of business, but the patient community is enthusiastic and growing quickly — there are currently 63,647 licensed patients and the state is receiving nearly 5,000 new applications per week. This is likely because Oklahoma is the most permissive medical cannabis state in the country, with no qualifying condition required to obtain a physician’s recommendation.

All of this adds up to a wide open market for anyone looking to invest in this industry. The business licenses are easy to obtain, especially in comparison to Arkansas and Missouri, and the regulatory burden for operators is quite low.

But the state has just passed a more comprehensive set of regulations, scheduled to take effect in August, and most observers expect the state to tighten application requirements in the near future. Many of the businesses operating now are not well-capitalized and will be hard-pressed to comply with the new regulations.

This creates a real opportunity for an experienced, well-funded operator to quickly establish dominance in a crowded field and take advantage of one of the country’s most robust markets.

Missouri

Missouri is still quite new, with 65.5 percent of the voters passing Amendment 2 in November. The state will issue a minimum of 192 dispensary licenses, 59 cultivation licenses and 85 processor licenses in a merit-based application process similar to that used in Arkansas.

The application forms and instructions will be available in June, with the submission period opening in August and winners chosen by Dec. 31. Missouri residents must be at least 51 percent owners of the applying entities.

There is still much about the Missouri market that has yet to be determined, including how many patients to expect. The Missouri amendment requires patients to be diagnosed with a qualifying condition before receiving a license, but the list of conditions is more extensive than the one in Arkansas.

The regulatory environment is still unknown, as the rules have not been issued, but early indications are that the state will devote significant resources to the effort. It has also spent the first few months of the year holding in-person meetings with stakeholders around the state seeking input on the rules as they are developed.

These are all indications that investors interested in Missouri can expect an intensive application process, a robust patient base and a responsive and comprehensive regulatory system.