Categories

On April 23, 2024, the Department of Labor (DOL) released its final overtime rule that’s estimated to make an additional four million American workers eligible for overtime pay under the Fair Labor Standards Act (FLSA).

What the Rule Does and Does Not Change

While the FLSA requires most employees to receive time-and-a-half overtime pay for all hours worked over 40 in a workweek, the law exempts some employees from that requirement. Specifically, employers are not required to pay overtime to “white collar” executive, administrative and professional (EAP) workers and highly compensated employees (HCE) if they are paid on a salary basis at a rate that meets certain thresholds and perform specific duties that are considered exempt under the FLSA regulations.

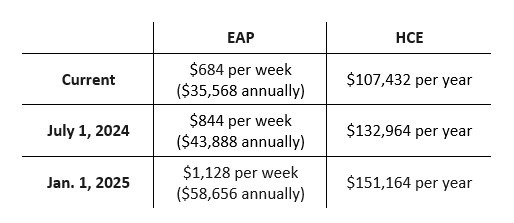

As expected, the final rule increases the salary threshold requirements for the EAP and HCE exemptions. The change will take effect in two stages over a six-month period:

Beginning July 1, 2027, the salary thresholds will automatically update every three years to reflect current earnings data.

Employers may still use non-discretionary bonuses and incentive payments (including commissions) that are paid on an annual or more frequent basis to account for up to 10 percent of an employee’s required weekly salary level. And employers will still be able to make a “catch-up” payment at the end of each 52-week period.

The “duties test” for the EAP and HCE exemptions remains intact under the new rule. So, if an employee meets the new minimum salary threshold but not the duties test for an EAP or HCE exemption, that employee would be entitled to overtime pay.

How Employers Can Prepare

A group of nearly 90 business organizations has asked the DOL to delay implementation of its final rule by at least 60 days, but an extension is certainly not guaranteed. Employers should be planning for and be prepared to comply with the new rule by July 1—which is fast-approaching.

Review all exempt positions and reclassify employees / adjust salaries. For those positions that pay lower salaries and typically require less than 40 hours per week, it would be logical to convert them to non-exempt and to pay employees for their occasional overtime hours. On the other hand, for those positions that pay higher salaries and require long hours, raising employees’ salaries above the new salary thresholds will likely cost less than what you would end up paying in overtime hours. Your review may also uncover that, despite meeting the new minimum salary thresholds, some currently exempt positions need to be reclassified because they fail to meet the duties test for an EAP or HCE exemption.

Keep in mind that you can pay non-exempt employees on a salary basis—just be sure to track all of their time and pay overtime for any hours that exceed 40 in a workweek.

Start having soon-to-be non-exempt employees record their time. This will help give you an idea of just how many hours a week they work (which may also help you decide what hourly rate to pay them) and will provide the employees an opportunity to get in the habit of accurately recording their time.

Carefully monitor newly non-exempt employees’ time. If your newly non-exempt employees were routinely working more than 40 hours per week before being reclassified, they may be tempted to work “off-the-clock” for a variety of reasons while adjusting to their new weekly work hour limitations. Remember that it is a violation of federal and state wage and hour laws to penalize employees for working “unauthorized” overtime by withholding payment for their overtime work. But you can discipline them for any unauthorized work time—just be sure to pay them for the time worked.

Review company policies and train managers. Make sure you have written policies that warn employees about off-the-clock work and mandate accurate recording of all work time (whether performed on-site or remotely). Also, decide how you are going to handle after-business hours communications and implement a written policy. Be aware of how your employees use home computers and smartphones. As soon as you reclassify them as non-exempt, your previously exempt employees will no longer be able to work and communicate with you 24/7 without being paid. They now will be on-the-clock, and you should compensate them for anything other than a de minimis amount of time spent on work-related matters, including electronic communications.

Train your managers on the coming changes and highlight the fact that previously exempt employees may struggle with the transition to recording their time. Once the new rule becomes effective, your managers will be in the best position to recognize (and curtail) after-business hours work/communications and ensure that newly non-exempt employees are accurately recording their time.

Start talking to employees about the transition and why it’s happening. Even in the absence of demotions and job duty changes, some of your previously exempt employees may feel as if they have taken a step backward. Help them understand that the transition is not a reflection of their performance and that roughly four million employees nationwide are facing the same reality.